The next Bitcoin halving countdown will reduce the mining reward to 3.125 BTC per block. This will increase the scarcity of bitcoin and potentially drive a new bull market.

The halving is a major event for bitcoin miners, but it also affects ETFs that invest in Bitcoin indirectly. The upcoming halving may result in increased trading activity and price volatility, shifting investor sentiment and market trends.

What is the Bitcoin halving?

The Bitcoin halving is an important event that occurs every four years and is one of the key features of the Bitcoin protocol. It reduces the rate at which new bitcoins are created by halving the mining reward. This is an essential part of Bitcoin’s deflationary economic model, which prevents it from becoming a fiat currency that loses value over time due to inflation.

The halving also helps ensure that Bitcoin remains scarce, which is a key aspect of its appeal to investors. By limiting the supply of newly mined bitcoins, it becomes more difficult for people to acquire them and drives demand, which can drive prices higher. This is in stark contrast to fiat currencies, which are prone to hyperinflation that can destroy their value over time.

However, there is more to the story than scarcity. Some analysts have pointed out that the halvings have historically coincided with cycles of expansion and contraction in the credit market, which could explain why the price of Bitcoin tends to rise following each event. This has led some to argue that the halvings are more like a form of monetary policy than simply an attempt to create a digital currency.

Another argument is that the halvings are intended to promote saving over spending. Because the number of newly mined bitcoins will be reduced, it will become more expensive to acquire them, which may encourage people to save their bitcoins instead of spending them. This has been criticized as a form of pyramid (Ponzi) scheme, but others have argued that it will help limit Bitcoin’s supply and improve its long-term value.

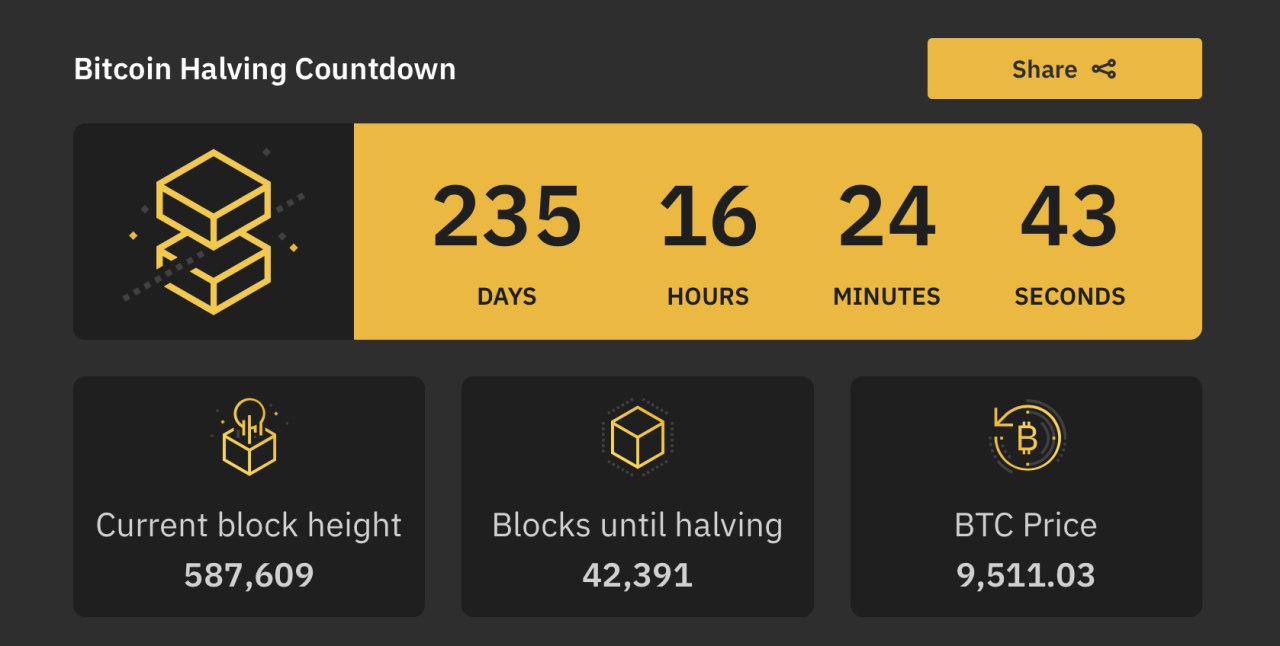

Regardless of the motivation, it is clear that the halving has significant effects on the price of Bitcoin and other cryptocurrencies. As a result, it is an event that is closely watched by both investors and miners. This countdown is designed to keep track of the current halving and future halvings, providing users with a convenient tool for tracking the latest developments.

How does the halving work?

Bitcoin halving involves the issuance of new bitcoins being reduced, and this has a direct effect on the cryptocurrency’s price. It’s a crucial event in the cryptocurrency’s life, and investors, miners, and enthusiasts closely follow it. In fact, many choose to accumulate bitcoins all the way up to a halving and then hope that the coin will skyrocket in value after the event.

When it comes to the actual halving process, this occurs when the number of bitcoins awarded to miners for successfully verifying and adding transactions to the blockchain is cut in half. This is done in order to slow the rate at which new bitcoins are added to circulation, and this helps keep the total supply stable.

Originally, miners earned 6.25 bitcoins for successfully adding blocks to the blockchain, but that amount will be halved in April 2024 to just 3.125. This is a huge reduction in payouts, and it’s expected to cause the price of Bitcoin to spike as demand for the digital currency increases.

The halving also has an important side effect: it helps to regulate Bitcoin’s inflation rate by limiting the number of new bitcoins that can be mined. This keeps the digital asset’s price stable over time, in contrast to fiat currencies that often decrease in value due to inflation.

This makes the halving an important element of the Bitcoin blockchain and one of the reasons why the cryptocurrency is so sought after by millions of people around the world. However, it’s important to note that the halving is not the only factor driving the price of Bitcoin. The overall crypto market’s performance and the strength of investor sentiment are more important determinants of price movements.

As such, making precise Bitcoin halving predictions can be challenging. The coin’s price is highly correlated with the average crypto market’s cycle, and past performance is not necessarily indicative of future results. As a result, traders should consider all factors when making their trading decisions, including the upcoming Bitcoin halving. Nevertheless, history has shown that the halving tends to correlate with bull runs in the crypto market, and it may be worth considering taking advantage of this opportunity.

How will the halving affect the price of Bitcoin?

As the halving occurs, the total number of Bitcoins in circulation will decrease, creating scarcity. This deflationary mechanism was built into the cryptocurrency by its creator (known only as Satoshi Nakamoto) to limit the supply and make each coin more valuable over time. It’s also designed to protect against inflation, as the rate at which new Bitcoins are created is fixed.

This event has historically led to increased demand for Bitcoin and a subsequent price increase, but each market is unique and can be influenced by many different factors. The halving is important for cryptocurrency investors and traders to keep in mind when making investment decisions.

The upcoming halving is scheduled for mid-April, and will reduce the reward miners receive from creating new bitcoins by half, from 6.25 to 3.125. This is expected to have a significant impact on the mining industry and could cause a ripple effect in the crypto marketplace. Miners may decide to hold on to their bitcoins in anticipation of a price increase, or they may sell them in order to stay profitable.

Investors are also keeping a close eye on the halving countdown in anticipation of a potential price increase. Many have already started to buy up Bitcoin, speculating that the reduced supply will drive prices higher. Others are diversifying into other cryptocurrencies or stablecoins to hedge against any potential price decreases.

It’s important for investors to be mindful of the halving, but it’s also critical to recognize that this is just one factor in a dynamic and evolving market. The Bitcoin price is constantly affected by market forces, regulatory updates, and broader economic conditions. While historical trends have shown that the halving is often followed by price increases, it’s impossible to predict the exact impact of this event. Investing in Bitcoin is a risky endeavor, and the price of this asset can fluctuate significantly from day to day. Investors should always conduct thorough research and seek the help of a qualified financial professional to ensure their investments are sound. This is especially true for those who are new to the crypto space.

How will the halving affect ETFs and altcoins?

Bitcoin’s halving cycle occurs every four years, and it is a major event for cryptocurrency investors. The halving reduces the number of new bitcoins that are mined each day and, in turn, raises the price of the digital asset. This is because the scarcity created by the halving creates a demand for the coin and reflects its finite supply. The halving is expected to affect the prices of other cryptocurrencies as well.

However, the halving does not usually cause a dramatic price movement on the day it happens. Instead, it is usually a gradual process that continues for months or even years afterward. This is because the impact of the halving reverberates throughout the crypto markets, and other coins tend to follow Bitcoin’s lead. In addition, the halving is often accompanied by media coverage and increased public interest in Bitcoin, which can increase its price.

The halving also typically leads to more speculation in the crypto market. This is because investors are eager to buy the asset in anticipation of the halving, which can drive its price up. However, it is important to note that this is a risky investment, and investors should always do their research before making any investments in cryptocurrency.

In addition, the halving can also have a significant impact on the performance of ETFs that invest in cryptocurrencies. For example, the Bitcoin halving has been a key driver of gains in the Amplify Transformational Data Sharing ETF (BLOK), which is up almost 13% this month and more than 18% year-to-date. This is because the halving will further restrict Bitcoin’s supply, which will lead to higher demand for the digital currency.

As a result, the halving is likely to boost the performance of both the BLOK and other cryptocurrency ETFs. However, it is important to remember that these ETFs are still very volatile, and past performance is not a guarantee of future returns. As such, investors should be prepared for significant volatility in the crypto markets ahead of the halving. However, if they remain cautious and focus on established assets with strong fundamentals, they can expect a positive return.